Insurance policy protection is something that everyone requirements to take into account at some point of their life, but Lots of people neglect it right up until It is too late. Irrespective of whether you are driving an auto, owning a home, and even renting an apartment, knowledge your insurance coverage is important to making sure that you are protected against unanticipated monetary burdens. In the following paragraphs, we’ll dive deep into coverage coverage, describing its significance, forms, and how to select the best protection for your requirements. So, Permit’s discover this matter intimately!

Not known Incorrect Statements About Group Insurance Solutions

When you believe of insurance coverage, the first thing that likely relates to mind is car insurance policies or dwelling insurance policies. They are the commonest styles, but Do you know there are several other kinds of insurance coverage which can help protect you? For instance, health and fitness coverage addresses medical fees, daily life insurance coverage provides financial protection for your personal loved ones, and disability insurance policies supports you in the event you’re struggling to get the job done. With a great number of possibilities offered, it’s significant to be aware of what Just about every style of protection presents And the way it applies to your daily life.

When you believe of insurance coverage, the first thing that likely relates to mind is car insurance policies or dwelling insurance policies. They are the commonest styles, but Do you know there are several other kinds of insurance coverage which can help protect you? For instance, health and fitness coverage addresses medical fees, daily life insurance coverage provides financial protection for your personal loved ones, and disability insurance policies supports you in the event you’re struggling to get the job done. With a great number of possibilities offered, it’s significant to be aware of what Just about every style of protection presents And the way it applies to your daily life.One of the crucial components of coverage coverage is recognizing the amount defense you'll need. For instance, when you’re leasing an condominium, you may not want as much coverage as somebody who owns a house. Even so, you still have to have adequate insurance policies to guard your possessions in case of theft, fireplace, or normal catastrophe. Furthermore, for those who very own an auto, your coverage must not only shield against incidents and also consist of legal responsibility protection just in case you're answerable for a collision that injures somebody else or damages their property.

The earth of insurance coverage is usually a little bit mind-boggling, especially if you’re new to it. But breaking it down into basic terms makes it much simpler to understand. Visualize insurance policy as a security Web. If something goes Improper, no matter whether it’s a car or truck accident, a house hearth, or a medical unexpected emergency, your coverage coverage acts as a cushion, assisting to soften the blow and forestall you from sinking into financial damage. Devoid of coverage, you might be left to cope with the total fiscal burden all by yourself, which may very well be devastating.

A further essential element of insurance policies protection is comprehension your coverage’s limitations and exclusions. It’s simple to think that insurance coverage will address every little thing, but which is not generally the situation. Each individual plan has precise limits on just how much it can pay out for differing types of claims, in addition to exclusions that define circumstances that are not included. Such as, a standard motor vehicle insurance policy plan may not deal with hurt due to flooding, or a house insurance policies coverage could exclude coverage for sure all-natural disasters like earthquakes.

Enable’s take a look at premiums. Premiums are the amount you pay out to take care of your coverage coverage, generally over a month to month or yearly foundation. Even though shelling out premiums is a vital element of having insurance plan, the amount you pay out will vary enormously based on numerous factors. These factors may consist of your age, driving heritage, the sort of protection you select, and in some cases where you reside. It’s essential to find a balance concerning paying A cost-effective premium and ensuring you've got enough coverage for your preferences.

When comparing distinctive insurance policies providers, It really is essential to look at more than just the worth. Although it’s tempting to Select The most cost effective selection, the best insurance plan protection isn’t generally the one particular with the bottom quality. As a substitute, focus on getting a coverage that offers extensive protection at a reasonable price. Make sure to evaluate what’s included in the policy, like the deductible, the coverage restrictions, and the exclusions. Chances are you'll realize that paying out a rather larger quality will give you superior Over-all defense.

Comprehension insurance plan coverage also indicates realizing when to update your coverage. Daily life alterations, for instance receiving married, possessing young children, or buying a new vehicle, can all influence the sort of insurance plan you will need. For example, if you have a escalating loved ones, you might want to enhance your lifestyle insurance policies protection to guarantee they’re monetarily guarded if one thing occurs to you. Similarly, following buying a new auto or home, you’ll want to adjust your protection to reflect the value of the new property.

One of the more puzzling facets of coverage is coping with claims. When you at any time end up inside a circumstance wherever you have to file a assert, it’s critical to grasp the procedure plus the ways included. The initial step is to notify your insurance company without delay once the incident happens. They'll guide you in the subsequent measures, which can consist of publishing documentation, submitting a law enforcement report, or getting an adjuster evaluate the damages. Comprehension this method can assist minimize pressure if you’re previously coping with a complicated circumstance.

Now, Enable’s discuss the different sorts of insurance policies coverage that people commonly buy. Automobile insurance is one of the most common and important kinds of protection. In most spots, It really is lawfully necessary to have not less than standard car insurance policy, which addresses liability in case you're at fault in an accident. Even so, a lot of motorists decide For extra coverage, for example collision or in depth insurance plan, Get all details to shield them selves in the event of a collision, theft, or weather-related hurt.

8 Simple Techniques For Insurance Risk Mitigation Solutions

Homeowners insurance is an additional essential coverage for anybody who owns house. This sort of insurance policy usually guards towards harm to your house caused by fire, theft, vandalism, or selected pure disasters. Furthermore, it may cover your individual possessions and supply liability coverage if somebody is wounded with your assets. For renters, renter’s coverage presents related security but applies only to your personal possessions, not the framework in the making alone.Health and fitness insurance is yet another essential sort of protection, making sure that you are protected in the event of clinical emergencies or regimen healthcare demands. Health and fitness coverage plans will vary noticeably depending upon the service provider, the program, as well as your certain demands. Some programs include a variety of solutions, while others could only include simple requirements. It’s necessary to thoroughly evaluate the designs available to you and consider things like premiums, protection restrictions, and out-of-pocket expenditures before making a decision.

When you've got dependents or family members who depend upon you fiscally, lifestyle insurance plan is something it is best to strongly think about. Everyday living insurance policies presents economical protection to the beneficiaries in the celebration of the Loss of life. The coverage sum can differ based upon your needs and Tastes. For instance, phrase life insurance policies provides coverage for just a set period of time, while whole life insurance gives lifelong coverage and infrequently includes an investment ingredient.

Disability insurance plan is yet another crucial but normally forgotten form of protection. When you turn into quickly or completely disabled and therefore are unable to operate, disability insurance coverage offers a source of income that Continue here may help you remain afloat financially. This can be a lifesaver for people who depend on their own revenue to support them selves and their households. Disability insurance is especially essential for those who don’t have other kinds of income or financial savings to slide back again on.

A Biased View of Auto Insurance Solutions

Another choice to contemplate is umbrella coverage. Umbrella insurance presents added liability protection previously mentioned and over and above your other guidelines, like auto or homeowners insurance. When you are involved in a lawsuit or experience a sizable assert that exceeds the limits within your Major insurance, umbrella insurance policy can assist protect the remaining prices. It’s A cost-effective way to include an extra layer of defense to your fiscal security net.

Insurance coverage is A necessary component of monetary organizing, and it’s something that shouldn’t be taken frivolously. Although it would experience like an inconvenience to critique policies, fork out rates, and keep track of unique protection styles, the relief that includes understanding you’re guarded is priceless. No matter whether you're looking to safeguard your automobile, dwelling, health, or lifestyle, the proper insurance plan protection might make all the real difference within the event of an unpredicted incident.

If you're still unsure about what varieties of coverage coverage are View more good for you, it’s worthy of consulting using an insurance plan agent or money advisor. They're able to assist evaluate your preferences and guide you thru the entire process of choosing the appropriate insurance policies. All things considered, insurance policy is about defending by yourself as well as your family members, and getting it suitable can offer a way of stability that’s challenging to put a price on.

In conclusion, insurance policies coverage is something which Everybody should prioritize. It offers a security Internet in moments of want, helping you recover from sudden events without the need of slipping into economic distress. With numerous sorts of insurance policy offered, from car insurance to lifestyle insurance policies, it’s important to Assess your preferences and select the proper protection for the predicament. By comprehending the basic principles of insurance, evaluating guidelines, and being in addition to your protection, you could ensure that you’re protected when everyday living throws a curveball your way.

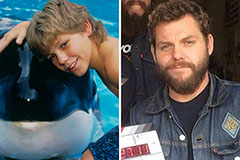

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now!